Back when John Liscio was alive, we used to joke with him about using a New York Post style headline, “Job shocker!” This month’s report would qualify.

• Employers added 312,000 jobs in December, 301,000 of them in the private sector. The headline gain was 122,000 above the average of the previous three months, even after the upward revisions to October and November. Though it looks giant by recent standards, the monthly gain in percentage terms was only at the 60th percentile of all months since 1950. It looks better if you start the clock at 1980: then, December’s gain is at the 73rd percentile. Over the year, total employment was up by 1.8%, the highest since 2016. It had been sagging through 2017 and early 2018, but has largely recovered.

• Gains were widespread across sectors. Mining and logging were up 4,000 (slightly below the sector’s average over the last year); construction, 38,000 (well above average, with heavy/civil unusually strong); manufacturing, 32,000 (a third above average, with nondurables in the lead); wholesale trade, 8,000 (slightly above average); retail, 24,000 (three times its average, with a large contribution from general merchandise); transportation and warehousing, 2,000 (way below average, with hard-to-adjust couriers down 5,000); finance, 6,000 (a third below average); professional and business services, 43,000 (a bit below average); education and health, a boffo 82,000 (the health subsector was half again above its average, but private education, apparently enjoying its liberation from federal investigation, up over five times its average); leisure and hospitality, 55,000 (more than twice its average, enjoying a boost from the returning Marriott strikers and a strong performance by bars and restaurants); and other services, 8,000 (somewhat above average). The only major sector in the red: information, down 1,000, in line with its average. Government added 11,000, well above average, with more than all the gain coming from state and local; federal employment was down. (This was all before the federal government shutdown.)

• November’s gain was revised up by 21,000, and October’s by 37,000. The combined total of 58,000 largely came from concurrent seasonal adjustment distributing December’s “surprise” backwards. Before seasonal adjustment, the combined gains in October and November were revised up 12,000; adjustment pushed that up to 58,000.

• Unsurprisingly, diffusion indexes were strong, with all intervals up to levels not only above their 2017 averages, but above the mighty 1995–2000 averages as well.

• The workweek rose 0.1 to 34.5, its level for eight months of 2018.

• Average hourly earnings were up 0.4% for both all workers and nonsupervisory workers. For the year ending in December, the all-worker series was up 3.2%, matching October; the latest readings are the highest we’ve seen since 2009. No major sector showed a decline, and a couple were quite strong, notably retail, up 1.1% for the month and 5.0% for the year.

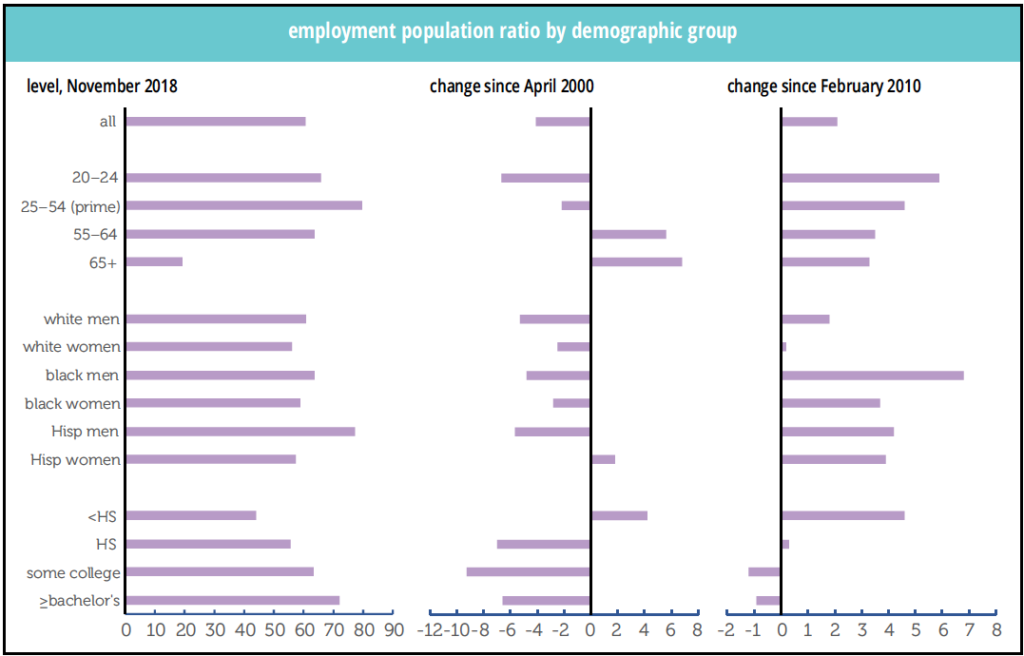

• The household survey was less exuberant. Total employment was up 142,000. When adjusted to match the payroll concept, household employment was up a more modest 180,000. On a yearly basis, which is a much better way to look at this volatile series, adjusted employment was up 1.8%, exactly in line with its payroll counterpart. Employment growth lagged the increase in the labor force, which was up 419,000. Consequently, the participation rate rose by 0.2, to 63.1%, its highest level in nearly five years, but the employment/population ratio was unchanged at 60.6% for the third consecutive month. Part-time employment was up by 159,000, though all of it came from the willing, up 305,000; those working part-time for economic reasons fell by 146,000. Unwilling part-timers accounted for 3.0% of employment, which is pretty much where the share has been since June.

• The number of unemployed rose by 276,000, and the rate rose 0.2 to 3.9%, its highest level since June. Because of separate seasonal adjustment, the component of the unemployed don’t add to the total, but voluntary leavers, a proxy for the quit rate, accounted for a big chunk of the increase, though the strong message of that number was countered by a relatively large number of permanent job losers. All durations of unemployment showed an increase except the very shortest, less than five weeks; the median and mean durations both rose 0.1 point, though they’re still at the low end of their recent ranges. The broad U-6 rate was unchanged at 7.6%. It’s up 0.2 since August.

• The age distribution of employment gains is curious. Given the volatility of the month-to-month figures in the household survey, we’ll look instead at changes for the year ending in December. Of the 2.9 million jobs gained over the year, nearly half, 49%, came from workers aged 55 and over, over twice their share of the workforce. Prime-aged workers, those aged 25–54, who account for nearly two-thirds of the workforce, or 64% to be precise, accounted for less than half the gains (45%). Their contribution was dragged down by the older group within that cohort, as the number of those aged 45–54 actually declined. Those aged 35–44 showed gains slightly smaller than their share of the workforce, while the youngest subgroup, 25–34, were up strongly. Also over-represented in the gains: older teens, those aged 18–19; just 2% of the workforce, they accounted for 11% of the year’s gains.

• Job flows numbers lacked drama, with all categories showing little change. One bright spot: the three-month month moving average of the share of the unemployed dropping out of the labor force—a lingering blemish on the expansion—fell to just 1.1%, matching the series all-time lows, set in late 2000.

Strong employment gains (at least in the establishment survey) and strong wage gains would normally excite some trigger fingers at the FOMC, though recent financial market turmoil might calm the itch (as Powell’s speech this morning suggests). With aspects of this expansion that look quite long in the tooth, you can’t not be impressed by these numbers.