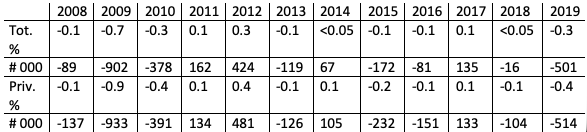

Benchmark Blues: BLS to Cut 0.3%, or 501,000 jobs, from 2019 levels

The extrapolation methods used by the Bureau of Labor Statistics in producing their monthly estimates (their word) of NonFarm Payroll (NFP) growth can obscure the magnitude of cycle turns, which is why it is important to pay attention to the annual benchmark, derived from the Unemployment Insurance filings mandated by federal law that cover 97% of the NFP universe.

The rule of thumb at the BLS is that if the benchmark falls between +/-0.2%, the average of the last 10 years, everything is copacetic, but if it exceeds that there is real information there. This morning the BLS released the preliminary benchmark for 2019 and, unfortunately, there is information there. The overall employment level is slated to be taken down by -0.3% or 501,000 jobs when it is made formal in January 2020, and in the private sector -0.4%, or -514,000 of the jobs previously estimated will be benchmarked away.

Largest losses are in logging & mining, -2.2%, or a scant -16,000 jobs, leisure & hospitality -1.1%, a not-so scant -175,000 jobs, retail trade -0.9%, or -146,400 jobs, professional/business services, -0.8%, or -163,000 jobs, and wholesale trade, -0.6%. Transportation & warehousing will be revised up 1.4%, or about 80,000 jobs, information 1.2% or 33,000 jobs, and government 0.1%, or 13,000 jobs. That’s it for the plus signs.

As you can see on the table, this is both out of trend, and the largest negative benchmark since the 2010 decline in the aftermath of the great recession.