Buybacks: A Turn toward Prudence, for Now

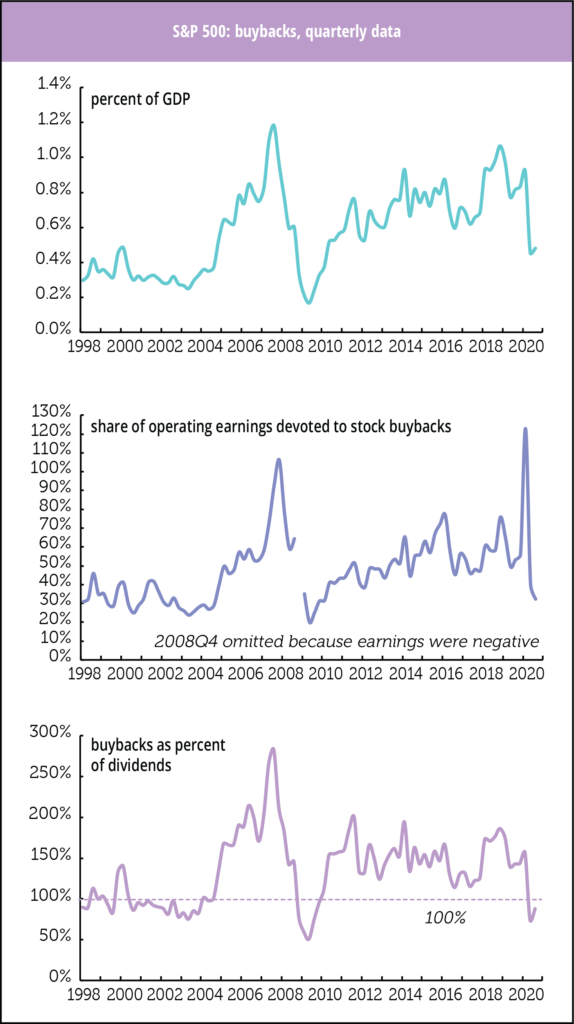

According to preliminary numbers from Standard & Poor’s, buybacks among S&P 500 components rose rose 15% in the third quarter, after a 55% decline in the second, leaving them 42% below a year earlier. Measured as a percent of GDP, buybacks are now in the same neighborhood they were last seen in in 2010—though that’s still well above where they were any time between 1998 and 2004.

Measured as a percentage of operating earnings, as in the second graph, buybacks fell to their lowest levels since 2010, 32%. Despite the increase in dollar volume, buybacks declined as a percentage of earnings because earnings were up 42% in the quarter. In the 40 quarters between 2010 and 2019, buybacks fell below 40% of earnings in just two of them; the average over that period was 53%.

And our third measure, buybacks relative to dividends, saw an uptick in the quarter, but remain at their lowest level since 2009, 88%. The second and third quarters were the only two since 2010 where traditional dividends exceeded buybacks; that was true of only half the quarters between 1998 and 2009. Between 2010 and 2020Q3, S&P firms bought back $5.7 trillion in stock and paid $3.9 trillion in dividends, a combined total of $9.6 trillion. Over the same period, earnings totaled $10.6 trillion. So, they paid out 90% of earnings to shareholders. After all these years of heavy transfers to shareholders—which, it must be said, have been very friendly to stock prices—you have to wonder why corporations don’t have better things to do with their profits. It’s as if Corporate America has become an old rentier, more interested in collecting cash than investing and innovating. Maybe this pandemic-induced reduction in buybacks marks a change of heart, but we suspect things will go back to the old ways in a few quarters.

Details on that Decline in UMich Expectations

This morning’s report on consumer confidence from the University of Michigan graphed the share of respondents reporting income gains as the reason for improved personal finances by income tercile. Although the trendlines remain sharply down for all three, the top tercile is climbing, with 44% mentioning income gains in early February, while the second and third continue their slides, with only 17% of the third tercile mentioning gains, the lowest level since 2014. Fifty-four percent of the top tercile reported their finances have improved, compared with 23% in the bottom third.

And that partisan divide just keeps growing. Overall the index slipped to 76.2 in early February from January’s 79; was basically unchanged at 86.2 v. 86.7 for current conditions; while expectations fell about 4 points to 69.8.

Within that, after rounding, the overall index among Democrats was unchanged at 90, down 1 point for Independents to 76, and down 6 points among Republicans to 64. Little change in current conditions among Democrats, 86, but Independents rose 5 points to 86, which cancelled out the 7-point fall among Republicans, 92. Same old unchanged for Democrats in expectations, 92, while Independents fell 5 points to 69, as did Republicans, but to 46.

Given his thinking that the new round of relief payments will reduce stress among those with lowest incomes, Richard Curtin found it “more surprising” that the outlook fell among consumers, but it’s far from a unanimous decline.