Health effects of Confusing Absolute w/ Relative?

Dr. William Darity, in charge of many things at Duke University, has been steadily advancing his theory of stratification economics, arguing that the ability of one’s parents to contribute to one’s resources is a bigger determinant of economic outcomes than education & hard work. He refers to the fact that blacks who have completed college have only two-thirds the net worth of whites who never finished high school as “one of the most dramatic statistics we’ve discovered.” That dramatic statistic, of course, has long roots.

However, in 2019 Darity, along with epidemiologists Arjumand Siddiqi, and Odmaa Sod-Erdene of the University of Toronto, and others, dug up a worrisome misperception in their report, Growing sense of social status threat and concomitant deaths of despair among whites. Revisiting Anne Case and Angus Deaton’s white “deaths of despair,” they add a third hypothesis to the two already out there, which include either the long-term or the contemporaneous decline in economic conditions driving the alarming trend in mortality.

Darity et al. find that the rise is not restricted to the lowest education groups, but is penetrating “deeper into the education distribution,” although with the most damage occurring among those with lowest educational attainment, and argue that economics alone cannot explain the increase in mortality among whites. If that were the case, the death rate among blacks, who are experiencing “parallel trends, and at more adverse levels,” would also be rising, but it was not pre-Covid. Instead, they point out that demographic groups tend to evaluate their positions relative to other demographic groups, not their peers, and that a rising misperception among whites that their social status is being undermined is a better explanation. Racial and economic anxieties are entangled.

“For perhaps the first time, we are suggesting that a major population health phenomenon – a widespread one – cannot be explained by actual social or economic status disadvantage but instead is driven by perceived threat to status.”

They call their findings stunning and startling, and we’ll add hard to wrap your head around. But if you have the stomach to read some of the racist and anti-Semitic claims being thrown around these days, their hypothesis is definitely worth some thought.

Manufacturing, Women & Labor Pain

It was encouraging to see solid gains in manufacturing & construction in the most recent payroll numbers, occupations listed as more stable, and therefore safer. Back in spring the idea was to get such work rolling again, while skipping the stop at a bar on the way home. We’re hitting the reset button on that.

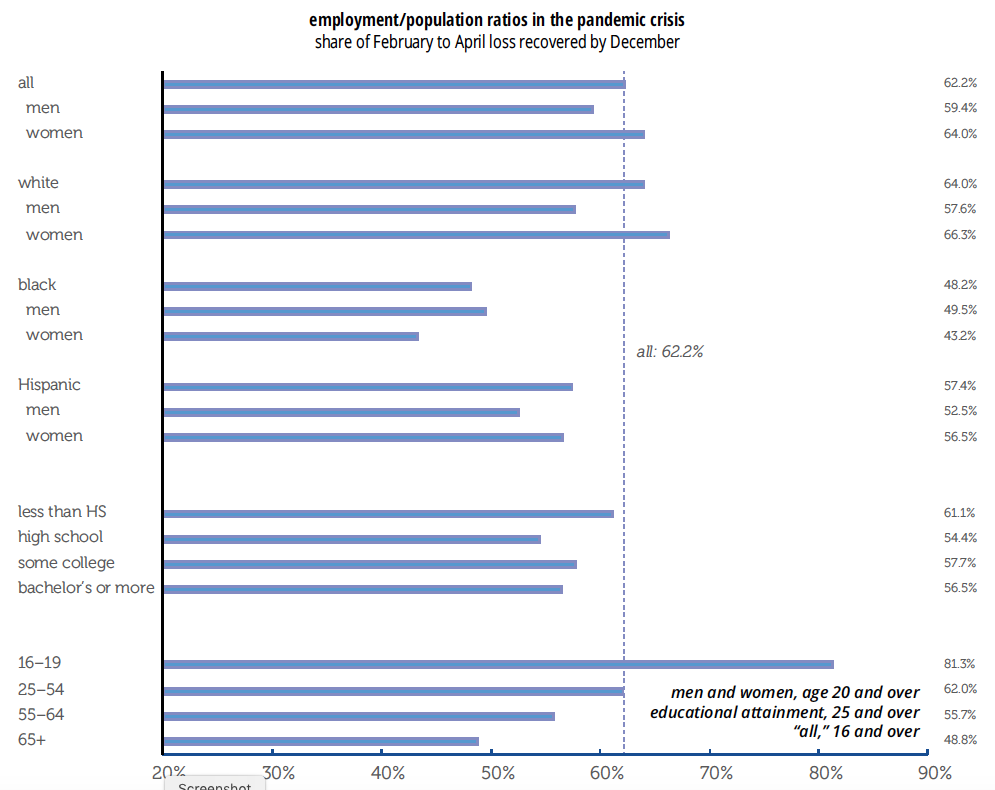

That may help get the pandemic under control, but it is going to hurt minority workers, as shown in Friday’s jobs report. The Household survey is jumpy, but the number of employed men rose, while the number of employed women fell. Within that both White and Black men gained jobs, as did White women, but Black women lost jobs, as did both sets of Latinx workers, and Asians, not broken out by sex. Gains were large enough to lift employment-population ratios for White women and Black men, while losses were enough to cause declines for Black women, Asians, and for Latinx men and women.

In 2019 women held 29% of manufacturing jobs and, within that, 39% of medical manufacturing and animal processing, 46% of sporting goods & toy manufacturing, and a little over half of textile manufacturing. Asian workers had a 7% share, but 29% of computer equipment; Blacks, 10%, and close to 20% of auto and pulp manufacturing; and Latinx, 17%, including 40% of fruit and vegetable preservation. Both Black and Latinx workers have close to 20% share in tire manufacturing, and 22% and 35% shares in animal processing plants.

Manufacturing employment is still down 4% over the year, less than overall employment’s -6%. We sometimes include a graph of the three-month average of manufacturing withholding in a classic Midwestern state. Here’s what that looks like these days: