The big question from last week’s pre-holiday jobs report, given the drop in the unemployment rate and a further drop in the labor participation rate, is why a tightening workforce isn’t resulting in long-delayed wage gains.

Thursday’s numbers were largely as expected: Nonfarm payrolls expanded by 223,000 (vs. 230,000 expected) as the unemployment rate dropped to 5.3 percent (down from 5.5 percent) to the lowest level in seven years. The numbers from the last two months were downwardly revised by 60,000.

[Co-]editor Philippa Dunne of research publication The Liscio Report notes that while the result may seem disappointing at first blush, it’s in line with the average of the past three months. And it still represented a bounceback from a weak first quarter, although we haven’t returned to the strength seen at the end of 2014.Yet average hourly earnings were unchanged in June from May, a slowdown from the 0.2 percent growth seen in the April and May and the 0.3 percent jump in March.

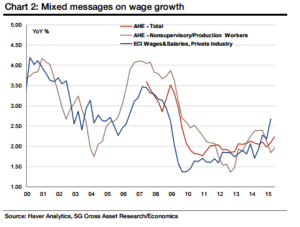

Aneta Markowska, chief U.S. economist at Societe Generale, notes that the lack of wage growth is at odds with the healthy pickup in the Employment Cost Index (ECI) in the first quarter, shown below, which indicates businesses are paying more for their workers. She wonders if this raises questions about the veracity of the ECI’s numbers given that it hasn’t yet been confirmed by other data sources.

The lack of wage inflation has led many to assume the Federal Reserve could possibly wait until December or even early 2016 before starting its rate hike campaign. As a reminder, the Fed hasn’t raised rates since 2006 and has maintained a 0 percent interest rate policy since 2008.

But this could be a mistake. At the current trajectory, the unemployment rate is on track to hit 5 percent in December. Fed Chair Janet Yellen has also said that wage growth is not a prerequisite for a lift-off in rates.

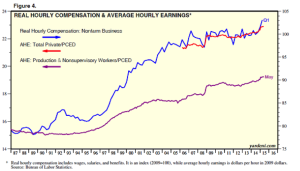

Also, while headline wages may have stalled, so-called “real wages” that take into account inflation are actually rising at a very impressive clip, according to Ed Yardeni of Yardeni Research. This supports the strong rebound in retail sales we’ve seen lately, which rose 1.2 percent in May. Personal consumption expenditures jumped 0.9 percent that month; real PCE rose at a 2.1 percent seasonally adjusted annual rate.

Want more? Consider that total real personal consumption expenditures per household rose to a record $96,550 in March on a seasonally adjusted annual basis — up 1.6 percent over last year and up 6.5 percent from the previous cyclical peak hit in August 2007.

What’s fueling this? Certainly, asset price gains from the rise in stock prices and the bounce back in home values are playing a big role. Yet so are wages: Real disposable personal income rose 3.5 percent in May with real wages and salaries up 4.8 percent. Real average hourly earnings for all workers in the private sector rose 2.1 percent year-over-year to a record-high $22.89 last month.

Given that the job market accelerated into the second quarter, these aternative measures of take home pay should continue their surge to the upside in the months to come.

As long as inflation remains tepid, real wages can keep growing even if nominal wages — the number on your paycheck — doesn’t move very much. The personal consumption price deflator (PCED) rose at just a 0.2 percent year-over-year rate in May. The core rate, which excludes food and energy, rose 1.2 percent.

Factors that are driving the slowdown in inflation include a drop in durable goods prices, with prices of used cars, furniture and bedding leading the way.

The takeaway is that while the headlines are saying wage growth remains stagnant, this dismisses the “real” gains to purchasing power consumers are enjoying thanks, in part, to cheaper second-hand goods.