As those who follow our work know, we have frequent, detailed discussions with senior revenue officials around the county on a regular basis. Withheld receipts are better tied to ordinary wages than are overall Personal Income Taxes, which include estimated payments on stock income and the like, and are out in front these days. Recently, when discussing growth in withheld receipts with our revenue contacts, we’ve been hearing from some: “Where are those wages we keep hearing about?

Maybe here: profits are up far more than wages in this cycle—almost three times as much. And that’s a real issue in our debt-laden economy, especially at the low end.

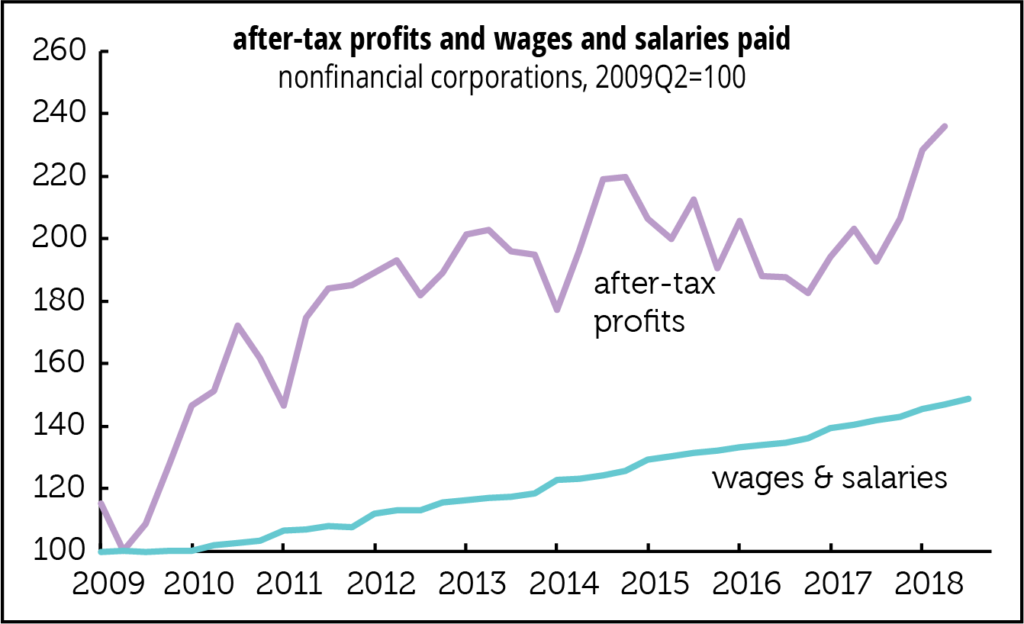

The two major factors of production, capital and labor, have enjoyed different rewards in this recovery/expansion. Graphed above are after-tax corporate profits and wage & salary payments by nonfinancial corporations, indexed so that the ending quarter of the recession, 2009Q2, is set to 100. (We use after-tax profits because those are what matter to shareholders, and because bookkeeping shenanigans at the end of 2017 and beginning of 2018 in anticipation of the tax cuts distort the numbers.)

Since mid-2009, nominal wages are up by 49%—but profits are up by 136%. (It’d be nice to present real measures but choosing the proper deflators would be a fatal challenge.) For a while, it looked as if profits had peaked in 2014, but they’ve made a healthy recovery since. And they got a splendid boost from the tax cuts.