Consumer Purchasing Power Rising Faster than Wages

The big question from last week’s pre-holiday jobs report, given the drop in the unemployment rate and a further drop in the labor participation rate, is why a tightening workforce isn’t resulting in long-delayed wage gains.

Thursday’s numbers were largely as expected: Nonfarm payrolls expanded by 223,000 (vs. 230,000 expected) as the unemployment rate dropped to 5.3 percent (down from 5.5 percent) to the lowest level in seven years. The numbers from the last two months were downwardly revised by 60,000.

[Co-]editor Philippa Dunne of research publication The Liscio Report notes that while the result may seem disappointing at first blush, it’s in line with the average of the past three months. And it still represented a bounceback from a weak first quarter, although we haven’t returned to the strength seen at the end of 2014.Yet average hourly earnings were unchanged in June from May, a slowdown from the 0.2 percent growth seen in the April and May and the 0.3 percent jump in March.

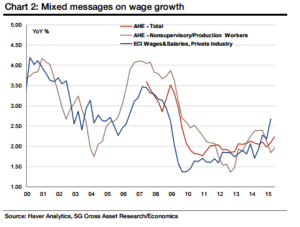

Aneta Markowska, chief U.S. economist at Societe Generale, notes that the lack of wage growth is at odds with the healthy pickup in the Employment Cost Index (ECI) in the first quarter, shown below, which indicates businesses are paying more for their workers. She wonders if this raises questions about the veracity of the ECI’s numbers given that it hasn’t yet been confirmed by other data sources.

The lack of wage inflation has led many to assume the Federal Reserve could possibly wait until December or even early 2016 before starting its rate hike campaign. As a reminder, the Fed hasn’t raised rates since 2006 and has maintained a 0 percent interest rate policy since 2008.

But this could be a mistake. At the current trajectory, the unemployment rate is on track to hit 5 percent in December. Fed Chair Janet Yellen has also said that wage growth is not a prerequisite for a lift-off in rates.

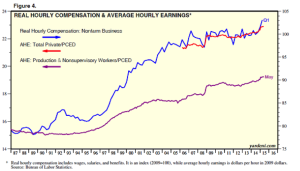

Also, while headline wages may have stalled, so-called “real wages” that take into account inflation are actually rising at a very impressive clip, according to Ed Yardeni of Yardeni Research. This supports the strong rebound in retail sales we’ve seen lately, which rose 1.2 percent in May. Personal consumption expenditures jumped 0.9 percent that month; real PCE rose at a 2.1 percent seasonally adjusted annual rate.

Want more? Consider that total real personal consumption expenditures per household rose to a record $96,550 in March on a seasonally adjusted annual basis — up 1.6 percent over last year and up 6.5 percent from the previous cyclical peak hit in August 2007.

What’s fueling this? Certainly, asset price gains from the rise in stock prices and the bounce back in home values are playing a big role. Yet so are wages: Real disposable personal income rose 3.5 percent in May with real wages and salaries up 4.8 percent. Real average hourly earnings for all workers in the private sector rose 2.1 percent year-over-year to a record-high $22.89 last month.

Given that the job market accelerated into the second quarter, these aternative measures of take home pay should continue their surge to the upside in the months to come.

As long as inflation remains tepid, real wages can keep growing even if nominal wages — the number on your paycheck — doesn’t move very much. The personal consumption price deflator (PCED) rose at just a 0.2 percent year-over-year rate in May. The core rate, which excludes food and energy, rose 1.2 percent.

Factors that are driving the slowdown in inflation include a drop in durable goods prices, with prices of used cars, furniture and bedding leading the way.

The takeaway is that while the headlines are saying wage growth remains stagnant, this dismisses the “real” gains to purchasing power consumers are enjoying thanks, in part, to cheaper second-hand goods.

Advanced industries

February 11, 2015

The Brookings Institution just published a paper outlining the importance of our advanced industries (AI), and a call to do more to support its growth. To be classified as advanced industries must spend more than $450 per worker on R&D, putting them in the 80th percentile, and the share of workers whose jobs demand a high degree of STEM (Science, Technology, Engineering and Math) knowledge must exceed the national average of 21%. Overall, industries so classed constitute our tech sector at its broadest: most manufacturing operations including aerospace, automotive, navigational instruments, medical equipment and supplies; energy including electric power, mining and extraction; and services, including architecture and engineering, data processing, satellite communication and scientific research.

Between 1980 and 2013 such industries grew 30% faster than the rest of the economy, or 5.4% annually, but employment levels held basically steady, largely because of productivity advances. Since the Great Recession both activity and employment have been on the rise, the sector adding one million direct jobs between 2010 and 2013, with employment and output rates 1.9 and 2.3 times faster than the nation as a whole. And AI employment has a high multiplier: those 1 million direct jobs likely generated another 2.2 million outside the industry itself, which compares to about 6 million total jobs created nationally over the same stretch. Advanced services were responsible for 65% of the total AI jobs, with computer design by itself up 250,000. Industries building transportation equipment have been adding jobs, finally, after decades of losses. A lot of attention has been focused on contributions to national payroll gains made by AI subsector gas and oil extraction since the recession.

A boost? Certainly, but dwarfed by the mothership.

Each worker in the sector generates about $210,000 in value added, in comparison to the $101,000 average overall, which helps offset the sharp increase in wages. In 2013 the average AI worker earned $90,000 annually, close to twice the overall average. Between 1975 and 2013 inflation-adjusted AI wages were up 63%, compared with 17% outside the sector. Total AI employment was about 12.3 million in 2013, about 9% of total overall employment, with another 27 million jobs riding AI's coattails. Together with the directly employed, that’s about one-fourth of US employment. Surprisingly, about half of the workers in the sector hold less than a bachelor’s degree, and Brookings ranks it as an accessible field. And one where more workers are needed.

Computer systems design owns the largest share of total AI employment, 13.8%, followed by architecture and engineering, 11.0% and management and technological consulting, 9.6%. Between 2010 and 2013 fastest rates of employment growth took place in information services, 10%; railroad rolling stock, 8.4%; automotive, 8.1%, and gas and oil extraction 7.6%.

Advanced industries tend to thrive in urban areas: San Jose is our most advanced hub, with 30% of the workforce laboring in the sector, followed by Seattle, 16%, Wichita, 15.5%, Detroit, 14.8%, and San Francisco, 14%. San Jose, Detroit and Seattle have the broadest array of advanced industry. (We’ll be presenting more data on this in coming months.)

We are losing international share, and there are a host of serious problems we like to nag about, but even in its somewhat weakened state our AI sector a powerful thing. And if we’re worried about productivity, as we should be, it’s a great place to start.