Tax Contacts: “Where are those wages?”

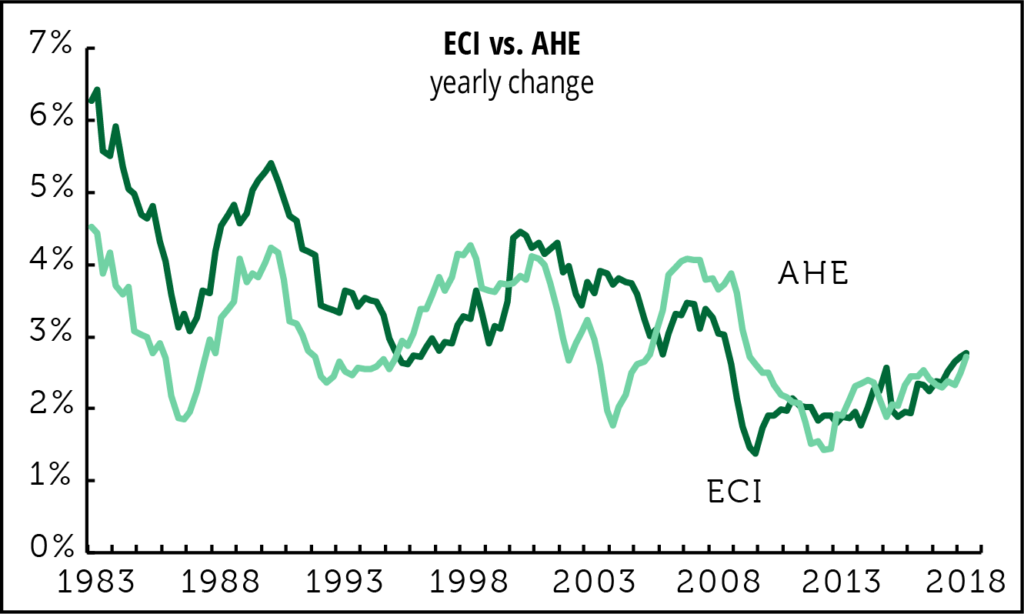

As those who follow our work know, we have frequent, detailed discussions with senior revenue officials around the county on a regular basis. Withheld receipts are better tied to ordinary wages than are overall Personal Income Taxes, which include estimated payments on stock income and the like, and are out in front these days. Recently, when discussing growth in withheld receipts with our revenue contacts, we’ve been hearing from some: “Where are those wages we keep hearing about?

Maybe here: profits are up far more than wages in this cycle—almost three times as much. And that’s a real issue in our debt-laden economy, especially at the low end.

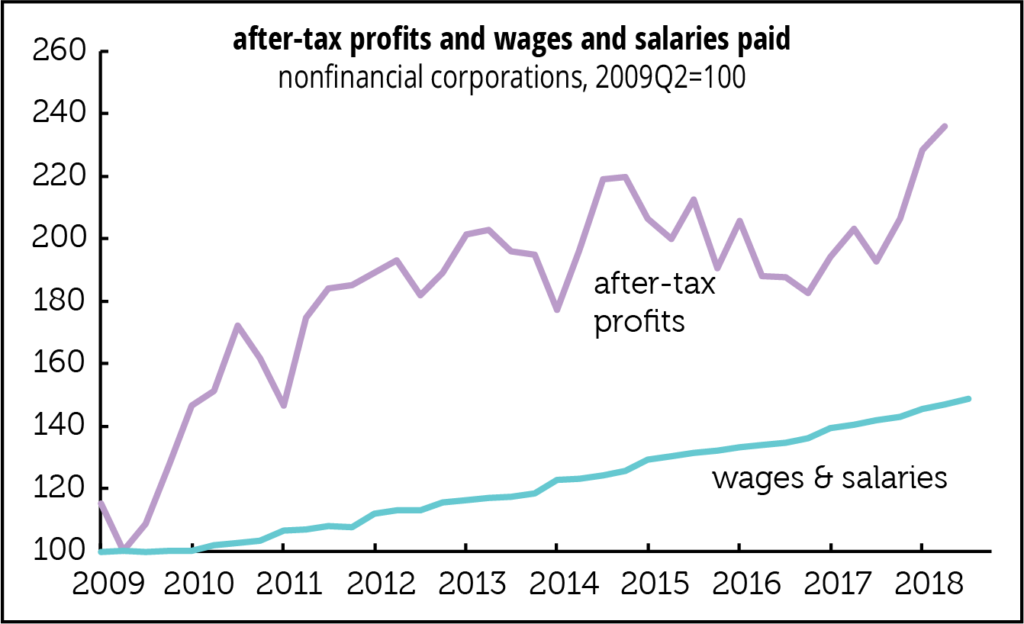

The two major factors of production, capital and labor, have enjoyed different rewards in this recovery/expansion. Graphed above are after-tax corporate profits and wage & salary payments by nonfinancial corporations, indexed so that the ending quarter of the recession, 2009Q2, is set to 100. (We use after-tax profits because those are what matter to shareholders, and because bookkeeping shenanigans at the end of 2017 and beginning of 2018 in anticipation of the tax cuts distort the numbers.)

Since mid-2009, nominal wages are up by 49%—but profits are up by 136%. (It’d be nice to present real measures but choosing the proper deflators would be a fatal challenge.) For a while, it looked as if profits had peaked in 2014, but they’ve made a healthy recovery since. And they got a splendid boost from the tax cuts.

Startups Only Stable. We’re Waiting….

We keep looking for evidence that policy changes coming out of Washington—namely tax cuts and deregulation—are stimulating entrepreneurship and so far we’re coming up empty.

The latest evidence comes for the BLS’s Business Employment Dynamics (BED) series.

The BED series isn’t the timeliest around—we just got the data for the first quarter. But we shouldn’t get too hung up on novelty; these things have long-term effects.

Establishment births, expressed as a percentage of total establishments, were unchanged between 2017Q4 and 2018Q1, at 3.1%. (Establishment deaths, which are available with an additional three quarter lag—you want to make sure they’re really dead and not just unresponsive—rose between 2017Q1 and 2017Q2.) That 3.1% birth rate is below earlier peaks in 2005, 2012, and 2015 (each of which was lower than the previous).

Maybe things will pick up, but they haven’t yet.