We’ve written about the sophistication and inclusion of coal-mining communities in their early days, of land theft, empty promises, and hopes that were revised away. In a new NBER working paper, Canary in the Coal Decline, Josh Blonz, Brigitte Roth Tran, and Erin E. Troland—the first and last of the Federal Reserve, the second of the San Francisco Fed—report on the broad effects of the decline in coal mining on household finances in Appalachia. Removing coal from our energy mix is a top priority if we want to clean up our energy act; everything about it is enormously filthy, from mining it to burning it. But what are the human costs of the transition away from it?

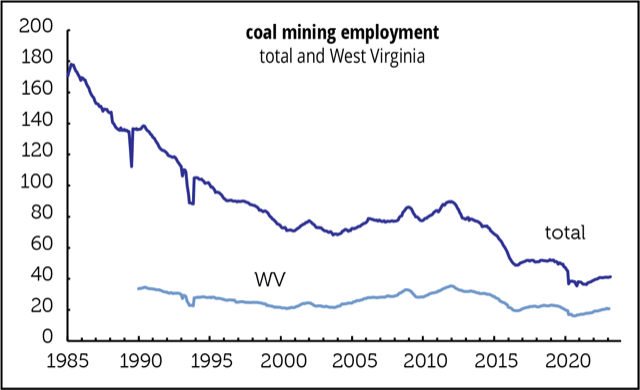

To answer those questions, the authors use data from the New York Fed/Equifax panel, which is the same source as the New York Fed uses in its consumer credit series. They look at important measures of household economic well-being between 2011 and 2018—a period when total employment in the industry fell by 43% as total employment rose 11%—in counties with a heavy concentration of coal mining. Here’s a long-term look at coal employment:

Coal-rich Appalachia has long been one of the poorest parts of the country, with relatively low educational attainment by national standards, a gap that has been widening. A good bit of the reason for this is that coal has been in decline for far longer than the last decade or two—it’s more like a century. Coal has become progressively less competitive economically compared to natural gas, as both plant construction and extraction costs have fallen (thanks to fracking, which won’t win any environmental awards either).

Even though coal accounted directly for only 2% of employment in what they define as active coal-mining counties, the economic impact of the decline was much broader and more severe than that small share would suggest. For example:

• Credit scores in coal-intensive regions were about 3 points lower than they would have been otherwise. That may not sound like much, but other researchers have found that even a 1-point decline can be economically meaningful. The effects went well beyond the 40,000 miners who lost jobs nationally over that seven-year period (three-quarter of them in this survey area). The effects were concentrated among those in the bottom half of the credit-score distribution. At the 40th percentile, roughly at the cutoff for subprime classification, the credit score hit was 7 points.

• Those credit score declines translated into a 50-basis point increase in mortgage interest rates.

• Declines in coal demand resulted in increases in the share of households ranked as subprime, more intensive use of credit cards, higher delinquencies and collection rates, and more entries into bankruptcy.

• Damage was felt most in the second-lowest quartile of credit scores—in other words, people were on the verge of falling into serious hardship. But even those in the top quartile take a hit—a small one, but evidently no one is safe from the contraction in coal country.

• None of these findings are driven by age.

As the authors note in their conclusion, these finding are a warning about what might happen in other fossil fuel producing communities as carbon-based energy sources recede in importance. They don’t note, but we will, that the political effects of this impoverishment can be harsh, underscoring the need to insulate affected regions against the harms coming from an essential energy transition.

Case study

A footnote to the above: a closer look at the state most closely identified with coal (both by outsiders and residents), West Virginia.

Having such a coal-centric economy has not been kind to the state. West Virginia has the second-lowest employment/population ratio (EPOP) in the country, 52.6%, just behind South Carolina and above dead-last Mississippi. That’s 7.6 points below the national average and 15.2 points below the leader, Nebraska. Even at the peak in the national EPOP, 64.7% in April 2000, it was turning in a miserable 52.8%.

West Virginia has the fifth-highest poverty rate, 15.0%, 3.8 points above the national average and nearly three times the state with the lowest rate, New Hampshire, 5.6%. Coal made a lot of people rich over the decades—just not ordinary West Virginians.

That’s why transformative work being done by outfits like the Ohio River Valley Institute is so important, as are targeted programs like the Hickman Holler Appalachian Relief Scholarship, founded by musicians Senora May and her husband Tyler Childers, to provide scholarships to regional schools like Morehead State University. MSU is known for its STEM programs, and HHARS is giving priority to African-American students. Regional farmers’ markets too.

Philippa Dunne & Doug Henwood

Shadblow, one of many popular names for Amelanchier, was once one of the first trees to bloom in the Appalachian spring.