Shady Jobs

Who knew that over 140 million acres of American forests grow in cities and towns, and trees occupying that 3.6% of the land in the lower 48 are responsible for close to one-fifth of the nation’s carbon capture? That popped out of recent study on projected growth of urban forests and climate change mitigation at the county level from the venerable American Forests, a not-for-profit working for better outcomes since 1875.

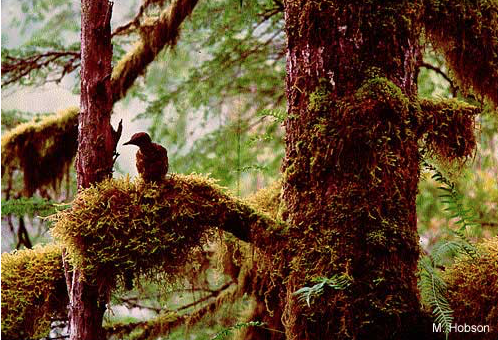

Linden flowers at the Illinois Institute of Technology

Linden flowers at the Illinois Institute of Technology

Yet those urban forests grow inequitably. In their introduction, American Forests’ scientists note that with a few exceptions, canopy cover in urban areas functions well as a map of urban inequality. Average canopy coverage in urban areas is about 39%. Within that, a recent study found that in formerly redlined neighborhoods canopies cover 23% of the space, whereas neighborhoods given high ratings, characterized by US-born white populations, had close to twice the canopy, 43%. In the authors’ own words, the “ranking system used by the Home Owners’ Loan Corporation in the 1930s parallels the rank order of average percent tree canopy cover today.” Quite the factoid.

Urban forests will expand with expansion of urban areas, but American Forests projects canopy coverage to decline to 33% by 2060, losing out largely to impervious cover. At the same time acres of rural tree cover will fall to construction equipment.

American Forests calculates that to offset loss of ecological services provided by urban forests if tree loss continues at the current rate, we would need to plant 23 million trees a year, one new tree a year for every 3 acres of urban land, which could be accomplished if each urban resident planted one tree every 12 years. An unlikely scenario.

But to do the full job, which would both balance their Tree Equity Index, and ameliorate the air pollution and heat-related illnesses that concentrate in poorer neighborhoods, we would need to plant and maintain 31.4 million trees a year, which would increase average canopy coverage to 43%. (And yes, it would be more efficient to do a better job protecting canopies, but that’s unlikely too.)

Green versus fossil fuel job projections are politicized, of course, and American Forests forecasts the full reforestation project would support 228,000 jobs annually, jobs that can’t be outsourced. American Forests’ efforts are targeted to people of color, and would provide outdoor work that might allay ongoing fears of covid infection and bring people back into the labor force. Nowhere near enough, but a start, and three times the jobs currently in shale extraction, despite much larger gains theorized by industry-funded research as the so-called Shale Gale was gaining steam a decade ago. (For reference, natural gas extraction, broken out in Quarterly Census of Employment and Wages but not in the Current Employment Statistics, was 30,000 in March of 2021. Toss in a representative share of support activities, and you’re at 75,000.)

And talk about bottlenecks. As many as aware, home gardening encouraged by covid has created shortages in fruit trees, but seedling production itself has been in long decline, exacerbated by the Great Recession. American Forests suggests we need to double seedling production to meet our reforestation goals, and, since nursery and reforestation jobs tend to be in economically depressed rural areas, unlikely to grow on their own these days, there’s an offset to our rural/urban inequality here as well. And it could break up worrisome concentrations of, say, poultry processing in the rural south.

Seedlings along the Chicago River

Seedlings along the Chicago River

In addition to those jobs, American Forests’ project, currently underway, would, as the trees mature, absorb 9.3 million tons of carbon, remove 57 tons of particulate pollution, and save the country $5 billion in combined air, water and climate services annually. That $5 billion alone is over half the cost.

American Forests’ tree equity tool, a targeted resource, covers 150,000 neighborhoods and 486 municipalities that constitute 70% of the US population, including socioeconomic status, population density, and current canopy cover. You can evaluate your own community as well as compare your own community to others here.

Large cities with the most to gain include Chicago, Detroit, Houston, Los Angeles, Memphis, New York, Oklahoma City, Philadelphia, and Portland.

Innovation Coda

Ben Christensen & Marisa Repka of Cambium Carbon, based in DC but operating nationwide, just won the JM Kaplan Fund’s innovation award. Thirty-six million trees fall in US cities each year, and their outfit, Cambium Carbon, creates a regenerative economy by salvaging those 46 million tons of wood, and using the proceeds to fund new tree planting, as well as keep usable material out of the waste stream. Might as well get with the terminology, so upcycling that wood into valuable, and scarce these days, durable goods brings local residents, many of whom face barriers to traditional employment, into the force where they learn technical skills across the tree life cycle, from tree care to carpentry.

Christensen and Repka had the idea when working with the World Resources Institute, observing that the kind of projects coming into the climate space from the financial sector, from private industry, and from the government, were all weak in terms of scalable projects. In their words, by transcending scale, their operation will bridge the “giant gap between supporting communities with the grace and specificity required to build effective local solutions…and the ability to scale those solutions into national climate initiatives.”

Their tagline? “Our wood does good.”