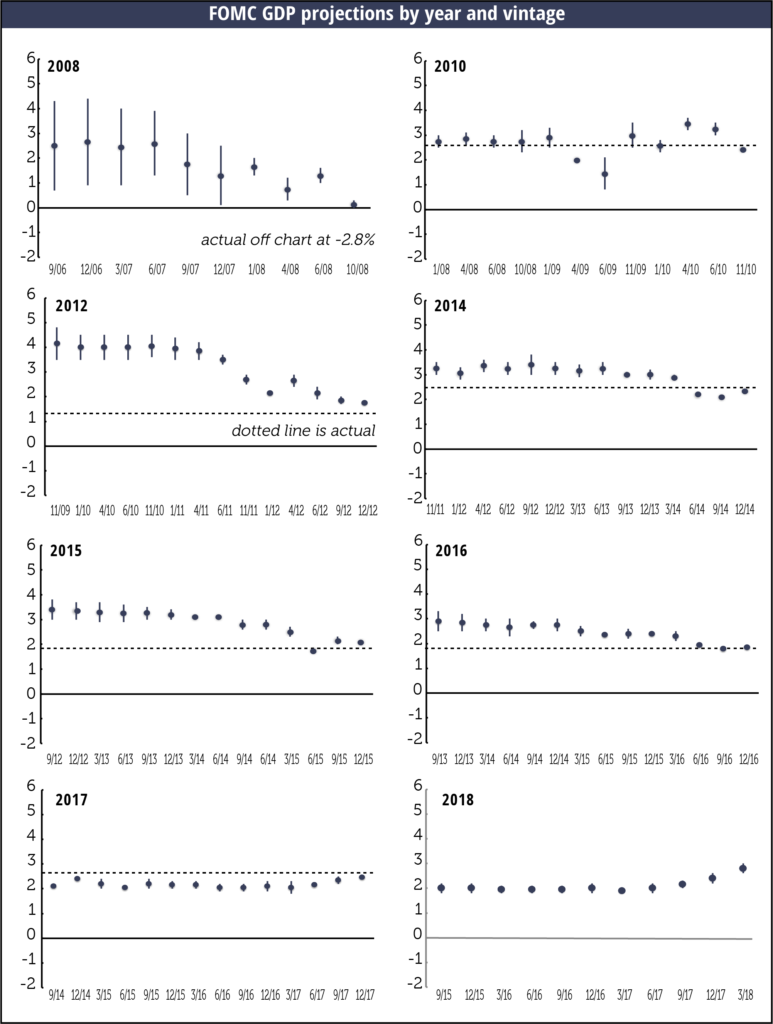

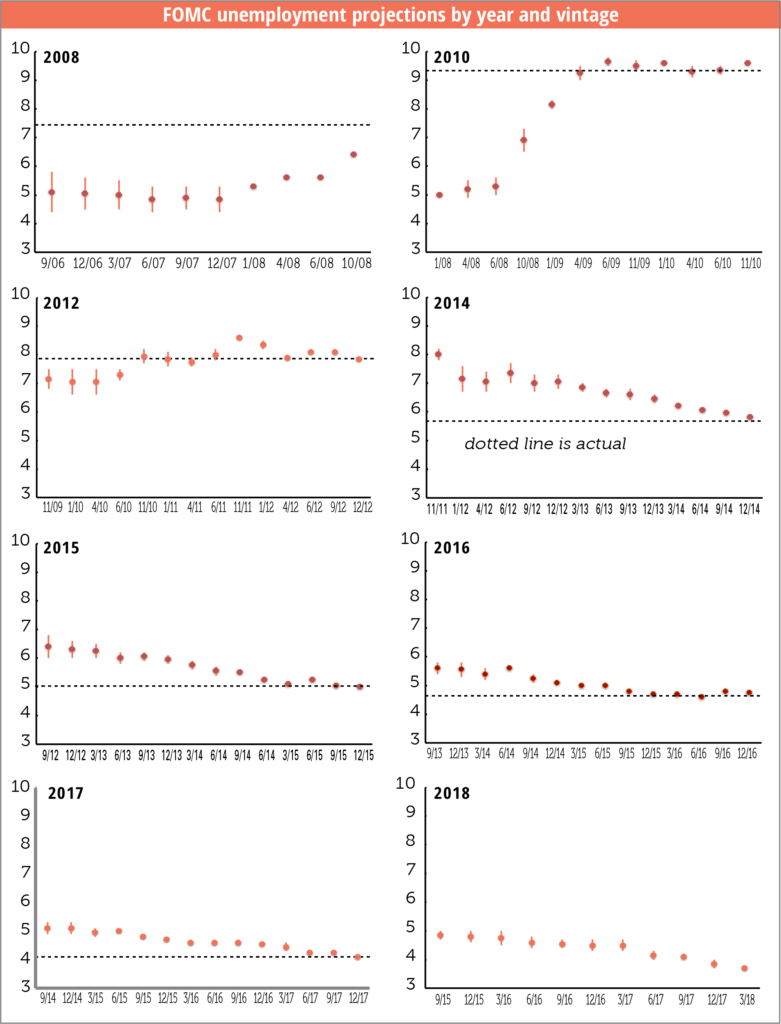

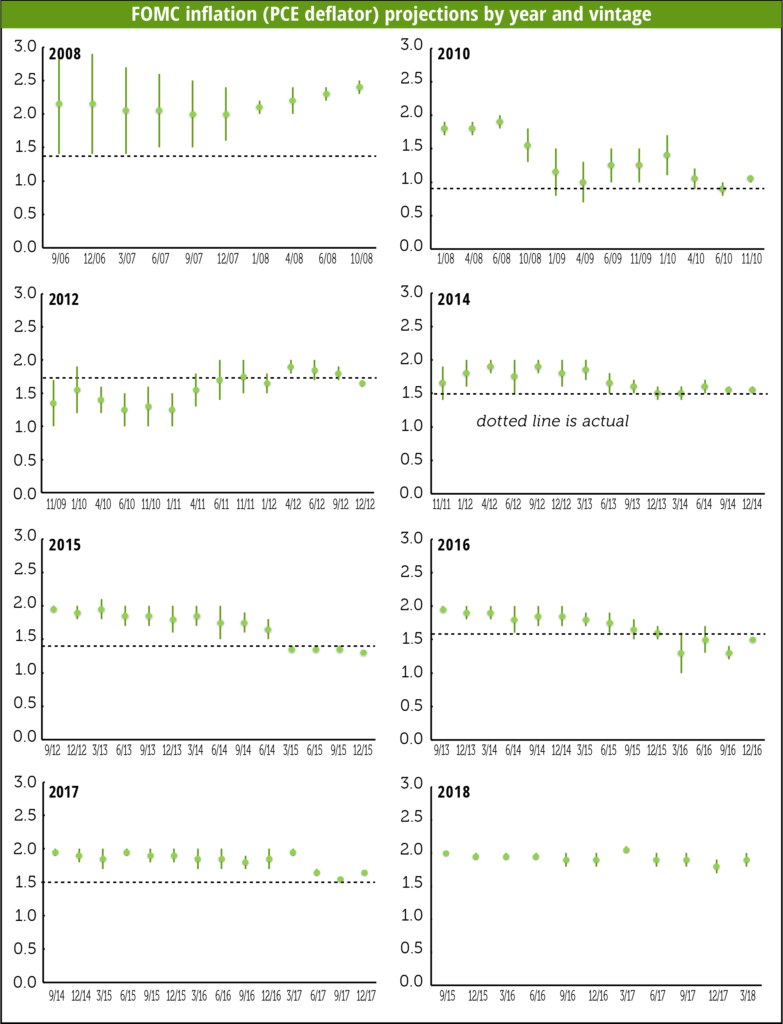

We thought some graphs of the FOMC’s projections and revisions would be useful as Chair Powell takes the helm. In a phrase, they’re pretty good when things are on trend, but they’re pretty bad when they’re not.

Note that they had no inkling of the 2008 recession. In fact, as late as October 2008, they were projecting 0.2% GDP growth for the year, when it turned out to be -2.8% for the year ending in 2008Q4.

Their projection for unemployment was almost a point too low. And their projection for inflation, even late in the year, was way too high.

They didn’t really begin to regain their bearings until well into 2010—but the forecasts for 2012 remained on the bullish side until late that year. More recently, they underestimated growth for 2017—though their projections for 2018 have been creeping higher.

Through most of this history, they’ve overestimated inflation. But now they’re projecting that it’s going to hang just under 2%. You have to wonder if they’ve finally figured this out just as the world is about to change.

We say this not to make fun of the Fed. Economic forecasting is a very hard job. Most forecasts just extrapolate the recent past into the indefinite future. Sometimes that’s the right thing to do—but not always.