Earth to Kevin Hassett: If you use that wrench…

The other day, Kevin Hassett, chair of the Council of Economic Advisers, dismissed concerns about slow wage growth by saying that if you deflated average hourly earnings (AHE) by the index for personal consumption expenditures (PCE) rather than the consumer price index (CPI) earnings look a lot better over the last year. And, he added, it’s a mistake to look only at direct pay because a lot of raises are going into benefits. There are two problems with his argument: first, AHE have looked a lot better if you deflate them by PCE for most of the last three decades, and for second, benefits are running only slightly ahead of wages in the private sector, and rather behind overall.

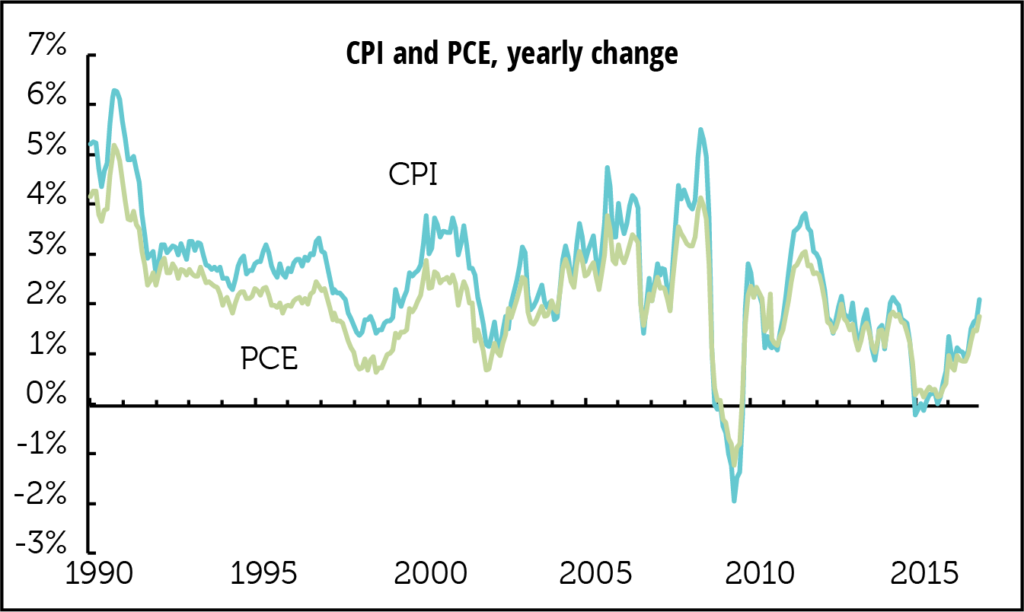

Here’s a comparison of yearly changes in the two inflation measures. In 88% of the months since 1990, the CPI came in above the PCE.

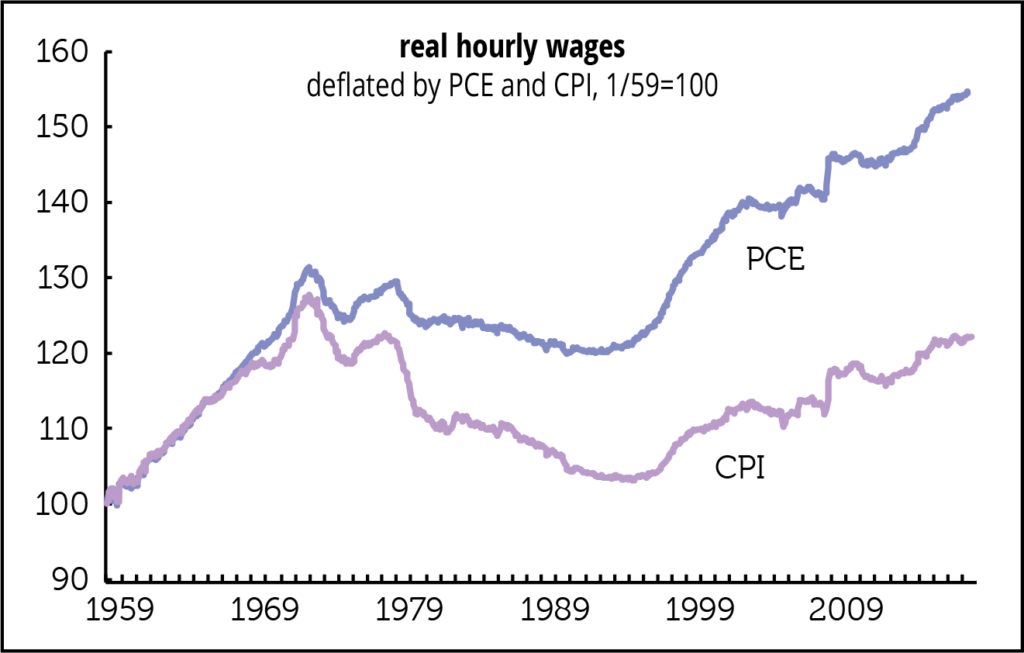

And here’s what AHE look like when you deflate them by the two measures. Since the all-private series only begins in 1964, and the all-worker series in 2006, we’ve chained nominal wages from those two series together with manufacturing (which go back to 1939) to produce a long-term measure. Using the CPI, real wages are 4% below their 1973 peak; using the PCE, they’re 18% above. We’ll leave the topic of which is the better measure for some other time. But any recent outperformance of real wages using the PCE rather than the PCI is a very old story.

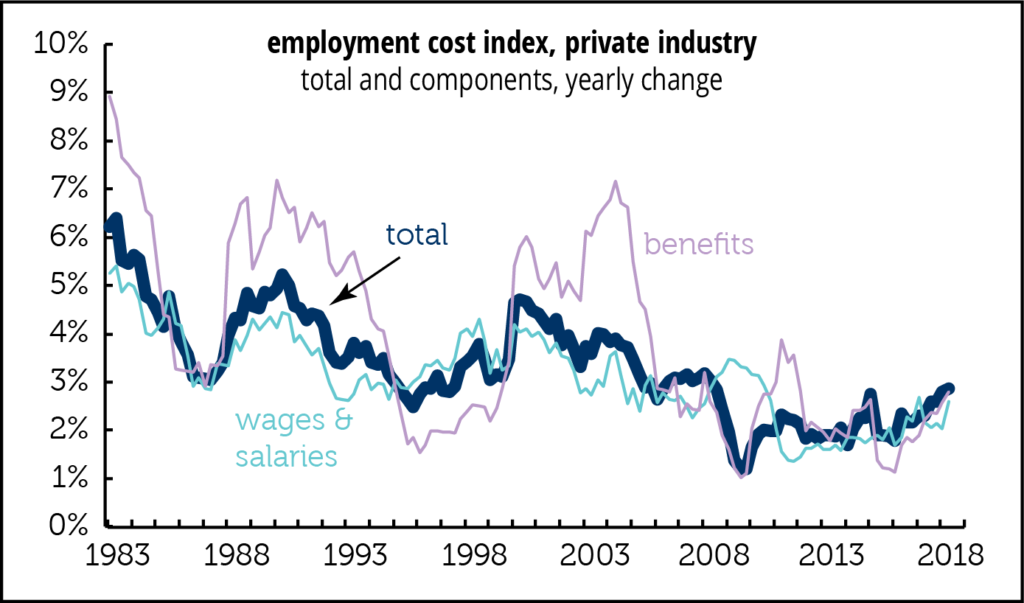

Finally, benefits aren’t doing that great. Here’s the history from the Employment Cost Index (ECI) series. Overall compensation growth in the second quarter was at the high for the cycle—but it’s below early troughs, like 1987, 1995, and 2006. Benefit growth is only slightly above wage growth, and is nothing compared to the bulges seen from 1988–1993 and 2000–2005. A major reason for this is the deceleration in health costs. Employers’ health costs were up just 1.5% for the year ending in 2018Q2, a third the 2010 average of 4.8%, and less than a fifth the 2000–2006 average of 8.2%. Health insurance costs are now lagging overall medical inflation; they exceeded it in the early periods by a wide margin. That suggests employers are shifting more costs to employees.

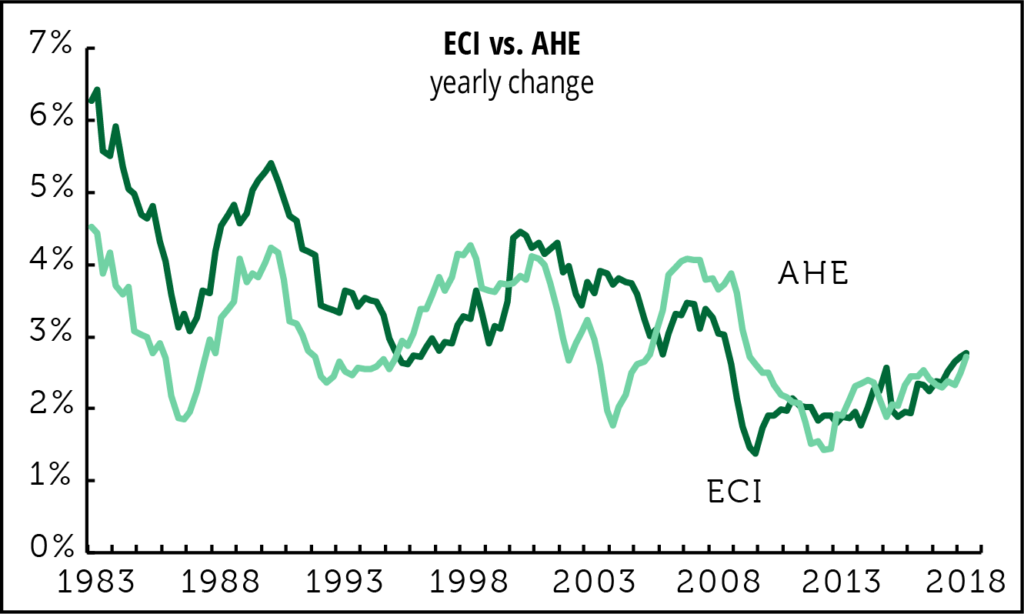

By the way, here’s what the ECI looks like compared to AHE. We don’t recommend making a habit of using the ECI as “truth.” When we asked an economist at the Bureau of Labor Statistics some years ago what he thought of substituting the ECI for AHE, he said, “If you use that wrench, you’re going to strip that bolt.” Kevin Hassett may need to visit his favorite hardware store.